Archive for the ‘Uncategorized’ Category

Give your employees a pay rise at no cost to you. Here’s how!

With the Eurozone in continued crisis, more cuts on the way and talk of a triple dip recession; keeping the lid on business  finances is vital. But how does that affect your employees?

finances is vital. But how does that affect your employees?

In many businesses April is pay review time. How will your employees feel if their take-home pay is falling in real terms? It seems that all but the top performers and job hoppers have seen their spending power fall in recent years with little prospect of recovery.

Fed up employees impact on your bottom line. Whether it is failing to come to work with their A-game, distracting others with their tales of woe or the simple act of quitting to go to a better paid job, they can undermine productivity and stop your business reaching its potential.

So its a delicate balance, as always, between payroll and profit and loss. However, if you’re looking to reward your employees there is another way. Employee benefits are a great way of putting money in your employee’s pockets without increasing your costs. In some instances it can actually end up saving you money.

Perhaps the best route to achieving this is through salary sacrifice – something many overlook. Both the employer and employee can benefit in the form of NI savings and/or reduced tax. Here’s a quick run through of how it works.

- Decide which benefits you want to offer your employees. These can be childcare vouchers, pension contributions, medical cash plan, cycle to work schemes, cars, laptops or wider benefits.

- Find a benefits platform to administrate your scheme. This part will cost you but don’t worry their fees will normally come out of the money you’ve saved in National Insurance and tax.

- Offer your employees the chance to voluntarily reduce their salary by the value of the benefits they want. These are then paid directly by the employer.

The recent changes to Child Benefit for higher earners means that some of your affected employees could end up getting some of their Child Benefit back if they use salary sacrifice.

As with any benefit, salary sacrifice needs careful explanation and communication to your employees. They will need to think about the impact of giving up salary in favour of benefits. In some instances they’ll need to get financial advice.

Sounds a good deal doesn’t it. Now if only you could find a company that’s interested in your business, can help you deal with all this, select a provider, source the benefits, communicate with your staff and give financial advice to your employees. The great news, if your reading this, is that you already have. 44 Financial have many years of experience of working with businesses like yours to install salary sacrifice schemes.

If you want one of our consultants to contact you simply click here.

Steve Clark

It’s all about You!

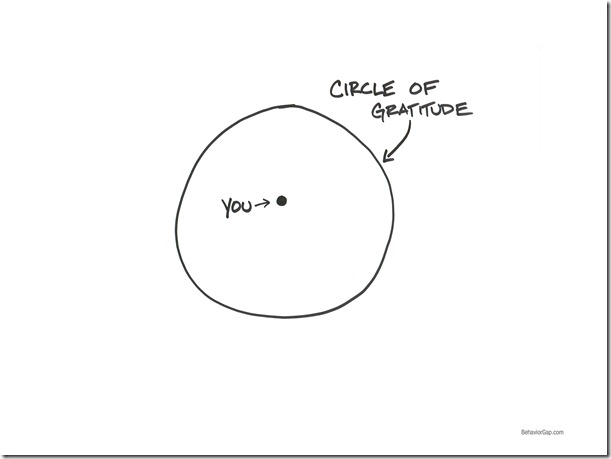

Every now and then I come across something that strikes a chord. You know it’s that feeling that makes you stop reading a newspaper article; pause and think.

I saw this drawing by Carl Richards and just thought– that’s it. That is what 44 Financial is all about! We always keep you – our clients – at the heart of everything we do and we are always grateful that you have chosen to work with us.

Our business is built on our Win2 philosophy. Read more about Win2 by clicking here.

As 2012 begins to draw to a close I wanted to take the time to thank you all for allowing us to be your trusted adviser. We really do appreciate your continued support and, as our business continues to grow, I wanted to reassure you that you will stay at the centre of everything that we do.

Thanks again. We look forward to continuing to work with you in 2013 and beyond.

Steve Clark

If you would like to find out more about Carl Richards and his great book -the Behavior Gap: Simple Ways to Stop Doing Dumb Things with Money (yes he is American!) you can click here.

Hutton report on public sector pensions – final date set

The Treasury has confirmed Lord Hutton will publish the final report of the Independent Public Services Pensions Commission on Thursday 10 March.

The report will lay out Hutton’s recommendations to government on “sustainable and affordable” pension arrangements, the Treasury said.

There is some talk about the relaxation of the rules on pension promises when employees are transferred out of the public sector. This is known as the “Fair Deal” regulations. If the combined political aim of The Big Society and Public Sector Deficit Reduction are to stand any chance of success these regulations need to be reviewed.

Those in the private and third sectors are not in a position to fund final salary benefit promises for employees who are transferred to them. Without some relaxation there will be less interest from organisations that the government needs to run these services in the future.

If, as rumoured, trades union pressure has led to the postponement of an increase in member contributions this will be disappointing. There clearly is a need to address the sustainability of public sector pension promises. In the last week the CWU union brokered a deal at O2 where employees voted to increase their contributions from 6% to 10% of salary in order to keep a final salary scheme. If it’s possible in the private sector surely the public sector should follow suit.

It looks like it’ll be an interesting week next week. Watch this space!

A gender for change

You may remember that we wrote about the European legal case that was on the horizon that could have a massive impact on the pensions and financial services industry. Well today is the day and the European Court of Justice has published it’s decision. You can read the full press release here.

From December 2012 unisex rates must be used when looking at premiums and benefits. What does this mean?

Is it just Sheila’s Wheels?

If you have listened to the TV or radio or read the newspapers they are very much concentrating on the impact that same sex rates will have on car insurance rates. Here’s a good example from the BBC.

If you have listened to the TV or radio or read the newspapers they are very much concentrating on the impact that same sex rates will have on car insurance rates. Here’s a good example from the BBC.

However, this judgement will go well beyond car insurance. It’s not just younger women drivers who will suffer the cost of the European unisex quest.

In fact the use of separate male and female rates stretches across the financial services industry.

Buying a Pension

One major impact will be in the rates that you can get when you come to use your pension pot to buy a pension at retirement. As women statistically live longer than men up until now for the same pot of money on the same basis at the same age a man will get more income. This was to reflect the fact that on average the man would be drawing his pension for less time.

From no later than December 2012 the rates will have to be the same. That’s going to create a bit of turmoil in the pension market over the next couple of years. It will also mean that those who are thinking about using their pension pot to buy a pension soon will need to get some advice regarding the timing of that decision.

From a pension scheme perspective the Financial Times have published an article commenting on the impact for company pension schemes that use annuities to provide income when a member retires.

One way or another if you are an employer with a pension scheme of any description you are going to have to sit down and look at the implications for your scheme. Even if you have a Stakeholder or Personal Pension Plan you may wish to alert members who may be considering taking benefits about this change.

Life Assurance, Income Protection & Critical Illness

These benefits – whether you take them out yourself or offer them through a company scheme – take into account gender differences. The different genders have statistically different claims histories and typical conditions. For life assurance for example it’s cheaper to insure a woman due to the longer life expectancy. In other words at nay age it’s less likely that a woman will die than a man of the same age if both are in good health.

We’re likely to see a change in the cost of these benefits as unisex rates start to be used. If you are looking at any personal cover it will be worth getting advice regarding whether it is wise to do this before December 2012 – particularly if you are a woman.

The Need for Advice

It’s clear that the impact of this judgement will be felt by far more than younger women drivers who may have to pay higher premiums. It will have a wide ranging impact for most individuals and their employers.

This will be a good test for how good your current adviser is. Firstly, to see how long they take to tell you about this and, secondly, how quickly they come up with a strategy for you!

Over time the financial services industry will work out how it intends to comply with the judgement. As we say all too often on this blog……watch this space!

5 Top Tips to protect your business

Just a very short post. As part of our service to clients we constantly scan all manner of information to try to dig out relevant information that our clients may have missed – and may be relevant to them. We do the hard work so our clients don’t have to!

It seems a shame to keep all this stuff to ourselves. So we thought, from time to time, when there’s something that we think will interest everybody, we’ll post it here on our blog.

The latest article we’ve received is from those very nice people at Pitmans who are a legal firm with offices in Reading and London. They’ve put together a really useful article setting out their five top tips for protecting your business in 2011. For those of you who have been following our blog there’s a nice concise bit in there on the removal of the Default Retirement Age. It’s something that we’ve written about in our article here.

There’s a link to the Pitmans article here.

We hope you enjoy it!