Posts Tagged ‘Protection’

Deadline to the Breadline?

Here’s a thought. It seems that the average person in Britain has only 19 days of savings to tide them by if the worst happens – e.g. loss of income, critic al illness or death.

al illness or death.

That’s according to the recent report from Legal & General.

There are some startling facts in there. For example the report reveals Britons typically spend more of their income on alcohol and tobacco than on protecting the income that pays for all of this with financial protection products.

And yet according to the British Gambling Prevalence Survey (BGPS) scratch cards alone were enough to tempt 24% of British adults to spend their money in this way, with 15% playing at least once a week. The “it’ll never happen to me” approach seems to be alive and well in Britain with only one in three UK adults having a life insurance policy in place.

This is disturbing when the average premium for life insurance last year, according to Legal & General, was only £189 per year. That’s around £3.50 a week.

As advisers we see the aftermath of both scenarios – those that have planned ahead and those that haven’t. Two recent cases bring that into focus for me. In both cases the husband was in his 40’s and died one very suddenly and the other after a short illness.

For the couple that had planned the wife was able to repay the mortgage and had additional money for income so that the future financial security of the family to be taken care of.

For the couple who had some cover but who hadn’t updated their policies the wife didn’t have enough money to repay all the mortgage. She has had to go back to full-time working just to be able to keep the house they live in. Childcare is a major issue and they rely on a network of carers, friends and family to make it all work. There’s little excess money for when things go wrong and not a lot for luxuries like holidays, birthdays etc, When I met the wife recently she was so upset that they hadn’t reviewed their protection to make sure that they had enough.

Don’t find yourself thinking “….if only”. The 44 Financial Ltd Family Protection Review has been designed for people like you. Quite simply we’ll work with you to make sure that you and your family have money when you most need it.

To book your initial appointment click here to contact us.

Steve Clark

Credit – Photo (Flickr – swan-t)

A Gender for Change – why women must pay more!

We’ve written in the past about the fact that the EU has outlawed the sale of financial products where the cost for the same cover differs between men and women. If you want a quick catch up you can click through to our previous post here.

We’ve written in the past about the fact that the EU has outlawed the sale of financial products where the cost for the same cover differs between men and women. If you want a quick catch up you can click through to our previous post here.

The biggest issue for women of all ages is that the price of Life Assurance, Critical Illness and Income Protection Cover is likely to go up. The crucial date when everything must change is 21 December 2012.

However, things are beginning to happen already. One of the biggest providers in the market, Scottish Provident, recently announced it has repriced some of its life insurance products for women.

Scottish Provident has calculated that women will face an increase of up to 15% for life insurance as prices equalise and women start to pay the same price as men. This is likely to be the same story when looking at Critical Illness and Income Protection Cover.

Any women out there who are looking to put in place new or increased cover – perhaps as a result of having a baby or moving home – should act sooner rather than later to save themselves some money. In a few months time the same cover is likely to cost you more – for the rest of the time you have the policy. A £5 a month hike in the cost of your cover will cost you an extra £1,500 over the life of a 25 year policy. Surely, a £1,500 saving is worth acting on?

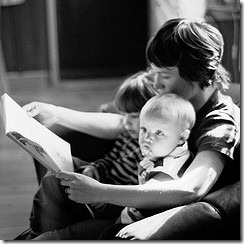

Of course looking protecting your family needs to be viewed as part of your overall financial roadmap. At 44 Financial Ltd we offer the Good Parent Review. This looks at exactly the types of issues that parents with young children may need to wrestle with. It’ll not only look at family protection but also issues of parental responsibility and wealth preservation if a parent dies.

As a father of three young children I am acutely aware of the need for parents and carers to be adequately covered. If you’d like to book an initial consultation contact us by clicking here.

Steve Clark

Related articles

One in every lifetime – there comes a chance like this!

Just a quick short post – mainly as a reminder rather than anything else.

Don’t forget that from 6 April 2012, the lifetime allowance will be reduced to £1.5 million (it’s currently £1.8 million). If you haven’t heard of the Lifetime Allowance yet then it’s unlikely you’ll need to worry. It only affects a very small number of people with large pension funds.

From 2012 there will be a new form of protection called fixed protection. This is available if you expect the amount of your pension savings to be more than £1.5 million when you come to take your benefits.It’ll allow you to keep the higher limit but will have to stop building up benefits in all registered pension schemes from 6 April 2012.

According to HMRC the application process should be available soon. If you think you’ll be affected you need to act soon.

If we can help at all please get in touch here.

Pension Snakes & Ladders – are you protected?

You may remember, back in the days when we thought that Pension Simplification would be just that, the government introduced a limit on the amount of money you could build up in registered pension schemes. This is known as the lifetime allowance. It started off at £1.5m in 2006 and has gradually grown to £1.8m in this tax year.

If you were affected by this limit, or thought you might be in the future, you could apply for protection. Not the type of protection you get from guys with sharp suits, wide lapels and violin cases but protection from the nasty tax charges that bite when you exceed the lifetime allowance.

In th is new era of financial austerity high earners are bearing their share of the financial pain. The Finance Bill 2011 will introduce a new lifetime allowance of £1.5m from 2012. It’s the Treasury’s version of pension snakes and ladders.

is new era of financial austerity high earners are bearing their share of the financial pain. The Finance Bill 2011 will introduce a new lifetime allowance of £1.5m from 2012. It’s the Treasury’s version of pension snakes and ladders.

So basically we are back where we started? No, not quite. The government have said that a new type of protection will be introduced. They’ve called it Fixed Protection. It will allow individuals to take advantage of the current £1.8 million lifetime allowance so long as they build up any further benefits. If you’ve claimed protection under the 2006 rules you can still have up to the £1.8m limit.

If you employ high earners with substantial pension benefits it’s worth looking at those whose pension values are between £1.5m and £1.8m

If you are an employee and you think that you may be affected you really should get some specialist advice.

Well there you have it. Pensions Simplification? As if!