Posts Tagged ‘NEST’

Employers struggle to achieve 2014 auto-enrolment

Less than 1 in 4 employers staging for auto-enrolment in the first half of 2014 have confirmed their provider and completed everything necessary to be ready to comply. This is according to a report issued by NEST the pension scheme of last resort for auto enrolment.

An article in Pension Expert magazine helps to underline the logistics of what UK employers are facing. This year over 25,000 employers are expected to reach their staging date. If you click here you can read the article. That’s the date upon which you have to comply with the new rules.

Although you can postpone your staging date for up to three months it still means that you have to have everything in place ready to go by the earlier staging date.

As if this wasn’t bad enough news the pensions industry is already hinting that from advisers through to providers it will be very challenging to support all these employers.

This is something that we can echo in our own business. We are currently running six projects for clients who stage this year and are about to take on another two. If there’s any advice that we can give employers it is – don’t sit on the letter from The Pension Regulator telling you when you need to comply. This isn’t something that you can easily do yourself in a month or so. We had a call last week from an employer who has to comply from 1 February who hadn’t done anything about auto-enrolment. Reluctantly we had to turn the employer away as there was no way we could get everything in place in such a short time without jeopardising the service our existing clients receive.

This is something that we can echo in our own business. We are currently running six projects for clients who stage this year and are about to take on another two. If there’s any advice that we can give employers it is – don’t sit on the letter from The Pension Regulator telling you when you need to comply. This isn’t something that you can easily do yourself in a month or so. We had a call last week from an employer who has to comply from 1 February who hadn’t done anything about auto-enrolment. Reluctantly we had to turn the employer away as there was no way we could get everything in place in such a short time without jeopardising the service our existing clients receive.

Our experience, which is backed by the views of The Pensions Regulator, is that ideally you would have between a year and eighteen months to complete the project. The last thing you want to be doing is having to make decisions under ti me pressure.

me pressure.

The Pensions Regulator knows – from your PAYE records with the tax man – when you have to comply. They will write to you about a year to eighteen months before your date. They know that within four months of that date you must go on-line on their website and complete the registration of your auto-enrolment scheme. They will start to write to you about that nearer the time. If you do nothing or are late The Pensions Regulator will know. They have the power to fine you. If you click here you can read more about how The Pensions Regulator will deal with non-compliance.

All is not lost though

As long as you have a reasonable time left we can still help. We offer a fully managed project that will make sure that you are fully compliant that deals with provider selection, assessment processes and software, communications, registration and governance.

Alternatively, we are working with some smaller employers on a more light touch basis where we effectively coach them on delivering their own project. At a time when money is tight form many employers this can be a good way of getting some advice to help you comply.

If you want to kick start your auto-enrolment project and get moving call us on 01163 800 133.

Steve Clark

Salary Sacrifice–Minimum Time?

We’ve been getting a number of questions from our clients regarding the minimum amount of time that a salary sacrifice agreement must be in place for.

We’ve been getting a number of questions from our clients regarding the minimum amount of time that a salary sacrifice agreement must be in place for.

This has come into sharper focus when looking at the new pension rules from October 2012 that will mean that employers have to automatically enrol employees into a workplace pension. Well those all round good eggs at HM Revenue & Customs have kindly produced an FAQ on the subject.

You can read the document here in all it’s glory.

The interesting part is when they discuss the new rules. HMRC says:

“Consequently, it is not necessary to stipulate a period for which the arrangement must be entered into or to set out "lifestyle changes" in relation to salary sacrifice for the workplace pension scheme.”

That’s good news for employers who have often struggled to define “lifestyle changes” to their employees. It also helps to reassure employers that they won’t be liable for a tax bill if the employee opts out of salary sacrifice.

It’s worth remembering that salary sacrifice needs to be established carefully and is a balance between changing your employees contracts and altering your benefit contributions. As always, it’s worth making sure that you get some advice when setting up a new arrangement.

Steve Clark

U-Turn on Planet Pensions

What a week its already been on planet pensions And it’s still only Tuesday!

Yesterday in our blog post on the new pension rules we first got some idea that the government was going to delay the introduction for some employers.  By the afternoon the Pensions Minister Steve Webb had confirmed the rumours. Smaller employers are, after all, going to be given a bit of breathing space.

By the afternoon the Pensions Minister Steve Webb had confirmed the rumours. Smaller employers are, after all, going to be given a bit of breathing space.

Now this is the same Steve Webb that told a conference almost a month ago to the day that there was no intention of postponing the introduction of the changes. It probably goes to show how little we can read into what politicians say!

So where does this leave us. It all depends on size and whether you are a small or large employer. Size is subjective and we all know that one man’s large is another woman’s small.

As it stands here is what we know from the announcement from the Department for Work & Pensions.

If you employ less than 50 employees

You’ll also get some breathing space. We know that you’ll be given until after May 2015 to comply. This is after the end of this Parliament. We’ll have to wait and see what happens at the next election. However, the government has stated that all firms will have to comply at some point.

to comply. This is after the end of this Parliament. We’ll have to wait and see what happens at the next election. However, the government has stated that all firms will have to comply at some point.

If you employ between 50 and 2,999 employees

You’ll get some breathing space. Your staging date will change but we don’t know by how much yet. The DWP will issue more guidance in January 2012.

If you employ more than 3,000 employees

You are unaffected by yesterday’s U-Turn. Your staging date is still the same. The very largest employers have to start complying from October 2012.

What does it all mean for me?

Our research indicates that the majority of companies with less than 50 employees don’t even know yet about these new pension rules.

There’s evidence that more employers in the 50 to 3,000 know about the changes but only a small proportion have started any serious planning.

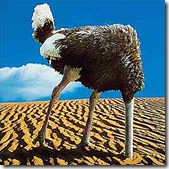

Clearly, if you are one of these employers you’ll benefit from the delay. What you shouldn’t do is simply stick your head in the sand hoping the whole thing will go away. It won’t.

The delay will allow you to start looking at the cost of compliance and what impact it’ll have on your business income. You’ll also have a chance to look at what you already have in place. It’ll give you time to work out what you have to do.

All is not lost!

Don’t worry if you haven’t had a look at the new rules and how it’ll affect you.

We’re talking to a growing number of employers who are taking this opportunity to look at whether they are employing the right adviser to see them through this minefield.

If you’d like to arrange an initial meeting to find out more about our active benefits service please email us here.

The Universe will provide!

Those all round good eggs at DLA Piper have just released their Be Aware March Edition of their monthly employment law newsletter. You can click through to it here.

There’s a really good article by Mary Clarke looking at Salary Sacrifice, Childcare Vouchers and the changes that come into play in April.

If you run one of these schemes it’s worth a read. If you don’t offer a Childcare Voucher scheme for your employees it’s still worth looking at – even after the changes. As a low cost benefit that is greatly appreciated by parents it’s a good way of extending your benefit programme at a time when costs are under scrutiny.

If you need any further help on Salary Sacrifice or Childcare Vouchers please drop us a line here.

Financial Times: Auto Enrolment will reduce profitability, deter investors and stall mergers

The FT published an article on Sunday by Debbie Harrison – one of their pension experts – that shows that the mainstream press are beginning to wake up to the impact that auto-enrolment and NEST will have on UK employers. It’s well worth a read.

Auto Enrolment will cost employers £5.5bn a year

We don’t think that any of the statistics and research quoted in the article is scaremongering by any means. Those close to the government within the pension industry have long been saying that NEST and auto-enrolment will cost UK employers billions. Even the CBI reckon that it’s going to cost UK employers well over £5bn per annum when you take into account the additional cost of administering this pensions monster. It’ll hit the bottom line for employers and, according to the FT, could deter investors and stall merger activity. That should make a few Finance Directors sit up and take notice we suspect.

At 44 Financial we’ve talked to our clients for some time about the impact that auto enrolment will have on them – looking at the direct financial impact as well as the indirect internal admin costs. Pleasingly, most of our clients and contacts are unlikely to cut the existing level of contributions downwards to match the least that NEST requires.

Levelling down of contributions

However, there are many employers who have in place a pension plan that is far more generous than NEST – often as a result of the closure of a final salary pension scheme. Automatically enrolling employees into these plans, when they already been offered membership have decided not to join, would have major cost implications for some employers. Our work with not-for-profit and third sector employers is a good example of this as contribution rates tend to be in excess of NEST but pension take up very low.

Some industries such as retail are very likely to end up with a two tier pension provision with NEST as the basic offering and possibly a more generous contribution level after a period of service. This kind of strategy would make sure that scarce resources are used to reward those in the organisation that are making a difference in the long run. During the period of potentially high staff turnover the employer pays the statutory minimum.

What’s your NEST survival strategy?

In summary it’s a very good article bringing together what pensions professionals, including 44 Financial, have said for some time. This year really is the year when employers must start to look at their NEST survival strategy.

If your existing adviser remains silent on NEST and auto-enrolment and how it will impact your organisation 44 Financial would be delighted to help. We are currently offering the first consultation in our Benefits Roadmap at our own cost to the first 20 employers who contact us. The Benefits Roadmap will, among other things, look at the impact of NEST and auto-enrolment.

Auto-enrolment is the biggest threat facing the most businesses in the next 12-36 months. Doing nothing is not an option.

Email us now at talk2us@44financial.co.uk – what have you got to lose?