Archive for the ‘Life Cover’ Category

Deadline to the Breadline?

Here’s a thought. It seems that the average person in Britain has only 19 days of savings to tide them by if the worst happens – e.g. loss of income, critic al illness or death.

al illness or death.

That’s according to the recent report from Legal & General.

There are some startling facts in there. For example the report reveals Britons typically spend more of their income on alcohol and tobacco than on protecting the income that pays for all of this with financial protection products.

And yet according to the British Gambling Prevalence Survey (BGPS) scratch cards alone were enough to tempt 24% of British adults to spend their money in this way, with 15% playing at least once a week. The “it’ll never happen to me” approach seems to be alive and well in Britain with only one in three UK adults having a life insurance policy in place.

This is disturbing when the average premium for life insurance last year, according to Legal & General, was only £189 per year. That’s around £3.50 a week.

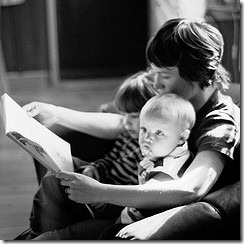

As advisers we see the aftermath of both scenarios – those that have planned ahead and those that haven’t. Two recent cases bring that into focus for me. In both cases the husband was in his 40’s and died one very suddenly and the other after a short illness.

For the couple that had planned the wife was able to repay the mortgage and had additional money for income so that the future financial security of the family to be taken care of.

For the couple who had some cover but who hadn’t updated their policies the wife didn’t have enough money to repay all the mortgage. She has had to go back to full-time working just to be able to keep the house they live in. Childcare is a major issue and they rely on a network of carers, friends and family to make it all work. There’s little excess money for when things go wrong and not a lot for luxuries like holidays, birthdays etc, When I met the wife recently she was so upset that they hadn’t reviewed their protection to make sure that they had enough.

Don’t find yourself thinking “….if only”. The 44 Financial Ltd Family Protection Review has been designed for people like you. Quite simply we’ll work with you to make sure that you and your family have money when you most need it.

To book your initial appointment click here to contact us.

Steve Clark

Credit – Photo (Flickr – swan-t)

A Gender for Change – why women must pay more!

We’ve written in the past about the fact that the EU has outlawed the sale of financial products where the cost for the same cover differs between men and women. If you want a quick catch up you can click through to our previous post here.

We’ve written in the past about the fact that the EU has outlawed the sale of financial products where the cost for the same cover differs between men and women. If you want a quick catch up you can click through to our previous post here.

The biggest issue for women of all ages is that the price of Life Assurance, Critical Illness and Income Protection Cover is likely to go up. The crucial date when everything must change is 21 December 2012.

However, things are beginning to happen already. One of the biggest providers in the market, Scottish Provident, recently announced it has repriced some of its life insurance products for women.

Scottish Provident has calculated that women will face an increase of up to 15% for life insurance as prices equalise and women start to pay the same price as men. This is likely to be the same story when looking at Critical Illness and Income Protection Cover.

Any women out there who are looking to put in place new or increased cover – perhaps as a result of having a baby or moving home – should act sooner rather than later to save themselves some money. In a few months time the same cover is likely to cost you more – for the rest of the time you have the policy. A £5 a month hike in the cost of your cover will cost you an extra £1,500 over the life of a 25 year policy. Surely, a £1,500 saving is worth acting on?

Of course looking protecting your family needs to be viewed as part of your overall financial roadmap. At 44 Financial Ltd we offer the Good Parent Review. This looks at exactly the types of issues that parents with young children may need to wrestle with. It’ll not only look at family protection but also issues of parental responsibility and wealth preservation if a parent dies.

As a father of three young children I am acutely aware of the need for parents and carers to be adequately covered. If you’d like to book an initial consultation contact us by clicking here.

Steve Clark

Related articles

Is your advisor saving you this much?

One of our main roles as your advisor is making sure that you get excellent value for the money that you spend on benefits. When it comes to our fees and costs nothing’s different. It can be a bit more subjective when we look at the value that we bring. Some of that will depend on the feedback that comes from employees who are members of the arrangements.

A good example is a recent reply to one of our LinkedIn updates that we posted. It was highlighting some research that Standard Life had done. The post basically stated that 72% of over 55s don’t think they can live on £140 a week State Pension. I got a reply from Ian Gray who was a client I advised on his retirement. Ian wrote in reply:

A good example is a recent reply to one of our LinkedIn updates that we posted. It was highlighting some research that Standard Life had done. The post basically stated that 72% of over 55s don’t think they can live on £140 a week State Pension. I got a reply from Ian Gray who was a client I advised on his retirement. Ian wrote in reply:

"Thanks to you Steve I do not have to. Many thanks for all your past advice. – Ian Gray"

We have loads more examples from clients of this kind of feedback that demonstrates that we are adding value for clients (and as importantly their employees) in everything we do.

But what about value you can measure?

Great feedback is fantastic and it shows us that we are doing something right. However, it’s hard to quantify in pounds and pence the impact that we have had.

Great feedback is fantastic and it shows us that we are doing something right. However, it’s hard to quantify in pounds and pence the impact that we have had.

When it comes to looking at the arrangements we look after for clients we can get this kind of quantative feedback. Forgive us for a little bit of self-publicity in looking at a recent case study involving one of our new clients that we have picked up from a national advisory firm. It demonstrates the value of what we do and the benefit of being with a pro-active advisor.

Since taking over we have done a full benefit audit. We’ve checked that everything has been set up correctly and that all of the benefits have been reviewed regularly.

So far (and there is still work to do) we’ve saved the company £25,629! Yes £25,629. This isn’t a large employer – they’ve got just over 30 employees. Here’s how we did it:

|

Description |

Amount Saved |

|

Review of Group Travel Insurance Policy |

£200 |

|

Waiver of Premium Refund Claim – Employer |

£9,787 |

|

Waiver of Premium Refund Claim – Employee |

£4,638 |

|

Review of Medical Care Scheme |

£7,252 |

|

Review of Income Protection Scheme |

£3,752 |

|

Total |

£25,629 |

That works out at a saving of over £95 for each day that we’ve been working for them! A tremendous result for the company in such difficult economic times. We’d like to think we could continue at that rate but sadly it’s not going to happen.

It’s not just about saving money. During our audit we’ve unearthed a Waiver of Premium pension

It’s not just about saving money. During our audit we’ve unearthed a Waiver of Premium pension![]() claim that had never been submitted, a temporary absence clause on the Group Life Scheme that leaves the employer badly exposed and group risk arrangements that we needed to bring into line with the Default Retirement Age "carve out".

claim that had never been submitted, a temporary absence clause on the Group Life Scheme that leaves the employer badly exposed and group risk arrangements that we needed to bring into line with the Default Retirement Age "carve out".

All in all, a good few months work. We’ve not only identified and released savings but also identified and mitigated a number of very real business risks.

If your advisor isn’t doing all that for you – isn’t it time you changed. Our example shows that the biggest in our industry aren’t always the best.

To arrange an initial meeting at our expense please contact us here. It may well be the best investment you ever make!

Steve Clark

All images courtesy of Flickr – Images_of_Money, woodleywonderworks. Photos8