My Pension Roadmap – Sat Nav for your Retirement!

We’ve recently launched a subscription based advice service called My Pension Roadmap. It’s aimed at the members of our group pension plans who want to know what it’s all worth and when they’ll be able to retire. We’ve extended it to all of our clients recently. You can read more about it here.

There are some really scary statistics being banded around in the media about exactly when we’ll all be able to stop  working. Of course that’s if we even want to! We mentioned the Oddfellows survey in our earlier blog article here. Not only do people have very little idea of what kind of savings they need – they are doing nothing about it.

working. Of course that’s if we even want to! We mentioned the Oddfellows survey in our earlier blog article here. Not only do people have very little idea of what kind of savings they need – they are doing nothing about it.

That’s where My Pension Roadmap comes in. We call it Sat Nav for your retirement.

But don’t take our word for it. Let us give you a real live example of My Pension Roadmap in practice. We’ve changed some of the personal details to protect the clients’ privacy.

Jim and Donna are both in their 50’s. They own their own home and the kids have all grown up and left home. Jim works in a factory and Donna is a nurse in the NHS. Apart from a short break to bring up kids Donna has always worked full-time. Jim has worked for several companies but has always been in the pension scheme. The couple have a modest standard of living and have always saved what they can.

The first stage of My Pension Roadmap is to sit down with Jim and Donna at the Discovery Meeting. This is when we really get to grips with what Jim and Donna’s ambitions are for their later years. For example we really drill down into issues like where they want to live, what they want to do with their time and what legacy they’d like to leave. We look at how they feel about taking risks with the money they’ve worked so hard to build up. We’ll also try to help Jim and Donna understand he risk v reward conundrum. The Discovery Meeting is part explanation, part education and mostly listening.

At our Discovery Meeting it became clear that Jim was becoming weary after a lifetime of work and Donna was really looking forward to reaching her retirement date soon. They both wanted to spend more time with their grandchildren. As avid caravanners they wanted to set off on a great adventure around Europe for a few months and wanted a new super duper caravan for this road trip.

We looked at the state pensions that Jim and Donna had built up and Donna’s NHS Pension. We also had details of Jim’s personal pension plans. The couple also have some savings.

Jim doesn’t think he’ll be able to retire until his state pensions kicks in when he’s 65. He doesn’t have a clear idea of how much his pensions are worth. The pensions that him and Donna have all be one payable at different dates and Jim admits he’s confused. Ideally he’d like to retire when Donna gets to 60 in a couple of years.

Jim doesn’t think he’ll be able to retire until his state pensions kicks in when he’s 65. He doesn’t have a clear idea of how much his pensions are worth. The pensions that him and Donna have all be one payable at different dates and Jim admits he’s confused. Ideally he’d like to retire when Donna gets to 60 in a couple of years.

After the meeting we went away to start collecting all the info we needed to be able to report back to Jim and Donna. My Pension Roadmap is designed to distill all the technical stuff down into something really simple and easy to understand. At the heart of My Pension Roadmap is your Retirement Cashflow. It shows you the estimated money in and money out and help you see whether you will achieve your goals.

Jim and Donna are over the moon when we tell them at our next meeting that they can both afford to stop working and do the things they want to in a little less than 18 months. Jim said it was like a weight lifted off his shoulders and  that he felt invigorated.

that he felt invigorated.

We are now in the process of implementing the changes that we recommended that’ll help Jim and Donna stand the best chance of meeting their goals. We’re moving Jim’s pensions into less volatile funds. We’re looking at getting updated State Pension Forecasts. Finally we’re moving into the discussion stage and looking at all the ways that we can turn Jim’s pension savings into an income for him.

Finally, we’ve transferred Jim’s pension plans into one pot. This means that not only will he pay less in charges but he can also pay his My Pension Roadmap subscription from his pension in product charges. And he’s still better off.

We’re really excited about My Pension Roadmap and we hope that people like Jim and Donna become it’s biggest ambassadors.

If you’d like to arrange a free initial discussion about My Pension Roadmap please contact us here.

We’re all doomed Captain Mainwaring!

We’ve been catching up on some reading recently after all the efforts to get the web site up and running. A few weeks ago the Department for Work & Pensions issued a short overview of what employers have to do to comply with the new auto-enrolment monster that’s about to hit us all. If you want to catch up on auto-enrolment here’s a link to one of our previous blog articles on the subject.

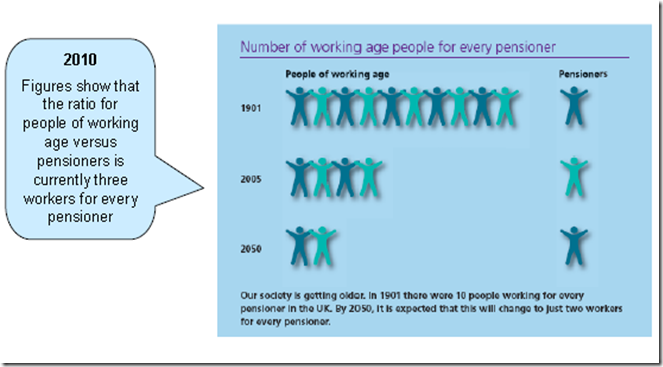

No, the thing that caught our eye in the DWP report – which you can read here – is the shaky basis upon which our state pension scheme finances are based. In the overview there’s an interesting diagram about how many workers are needed to support every pensioner that gets a state pension. We’ve included it below:

Source: DWP – Automatic Enrolment and Workplace Pension Reform – the facts. May 2011

By the looks of it by 2050 we’ll each have to adopt a pensioner and pop round every month with their pension money! Clearly, this can’t go on. That’s why successive governments have ducked the issue of state pension reform as it’s such a long term  issue. The Coalition are looking at ways of reforming the state pension by increasing the age that you can draw benefits and moving towards a flat rate £140 per week benefit. But the pay-as-you-go system that we have – where money we pay today is paid straight out in pensions – will still reach crisis point at some point in the future. Our kids and grandkids will no doubt be responsible for sorting out the mess then.

issue. The Coalition are looking at ways of reforming the state pension by increasing the age that you can draw benefits and moving towards a flat rate £140 per week benefit. But the pay-as-you-go system that we have – where money we pay today is paid straight out in pensions – will still reach crisis point at some point in the future. Our kids and grandkids will no doubt be responsible for sorting out the mess then.

Compulsion – but not as we know it

That brings us in a roundabout way to the thorny issue of savings. If we are only just going to get enough from the government to survive on the responsibility is on us all to save up now for retirement. The government thinks so too that’s why it’s making every employer in the UK automatically enrol the vast majority of their employees in a workplace pension scheme.

There are reams of research to show that most of us have been seduced by the live fast spend fast culture that the last few decades’ prosperity have  brought us. The Oddfellows issued a report last year that showed that less than one in five people had any idea what they needed to be saving up for when they stopped working. Yet there’s a feeling that when the new pension rules come in a significant number of people will opt-out. Although they won’t have to pay the contributions required they’ll also lose the employer’s contribution.

brought us. The Oddfellows issued a report last year that showed that less than one in five people had any idea what they needed to be saving up for when they stopped working. Yet there’s a feeling that when the new pension rules come in a significant number of people will opt-out. Although they won’t have to pay the contributions required they’ll also lose the employer’s contribution.

Opt-out or Opt-in?

There’s got to be an argument to say that by all means they can opt out but they still get the employer’s money. After all as a little salesman outside a carpet store in Jaisalmer said to me (on only about 100 occasions) “Something is always better than nothing”.

Our view is that eventually the ability to opt-out will disappear as so much of our future state pension planning depends on us taking responsibility for our own savings. Once it’s gone we’ll be in the situation where pension membership is compulsory – just like we were up until the 80’s when the then Conservative government abolished compulsory pension membership. Twenty odd years later and we’ve come full circle only the pension benefits on offer are a shadow of what they were in the 80’s.

A Cunning Plan?

I fear that as a nation our behaviour must change if we are to avoid living on £140 a week. I think that there is no silver bullet. Yes we need compulsory saving. If we are not going to do it ourselves we need help. But we also need to get basic financial education back into the schools. I recall the local saving bank coming into our local primary school in Dundee many years ago to collect savings. Most of the class saved something. Now you can get a credit card as soon as your 18.

Our policy to sorting out the financial health of our population has got to be more joined up and less of a knee-jerking, zig-zag of sound bite policies.

Oh, and by the way, something was indeed better than nothing. We eventually bought a wall hanging from the wee man in Jaisalmer and it still hangs in our lounge ten years later!

Steve Clark

Who do you trust when you buy an annuity?

We have been working with a couple of clients recently who have subscribed to our Retirement Options Programme. Basically this advice service leads you through the many options for turning all of your accumulated pension plans into a regular income. This being the pensions industry there’s always more than one way to skin a pensions cat!

The last two annuities we set up showed how poor the income was that was being offered by the existing insurer. In the first case we increased the clients income by nearly 30% and in the second case by just over 25%. This is a huge increase in income that’s payable for the rest of the client’s life. Depending on how long these clients and their spouse’s live the extra income could run into tens of thousands of pounds.

Depending on how long these clients and their spouse’s live the extra income could run into tens of thousands of pounds.

These two cases are for straightforward annuity purchases. Neither of these clients qualified for any enhanced annuity because of ill-health or lifestyle issues.

Needless to say both clients are incredibly pleased that they joined the Retirement Options Programme and took our advice.

Pension providers will now do more to encourage customers to shop around before buying an annuity. The trade body the Association of British Insurers has published a new ‘Best Practice Guide for the Retirement Process’. It sets out the principles pension providers are expected to follow. It’s designed to help increase customer understanding of retirement and purchase the right annuity for their circumstances.

The question is this – do you trust your provider to point you in the right direction or would you like to be in the same position as our clients above who have squeezed the maximum income from their pension pot?

If you are near retirement and would like to join our Retirement Options Programme please contact us here. Don’t forget once you’ve bought your annuity it’s too late to do anything about it.

If you are near retirement and would like to join our Retirement Options Programme please contact us here. Don’t forget once you’ve bought your annuity it’s too late to do anything about it.

One in every lifetime – there comes a chance like this!

Just a quick short post – mainly as a reminder rather than anything else.

Don’t forget that from 6 April 2012, the lifetime allowance will be reduced to £1.5 million (it’s currently £1.8 million). If you haven’t heard of the Lifetime Allowance yet then it’s unlikely you’ll need to worry. It only affects a very small number of people with large pension funds.

From 2012 there will be a new form of protection called fixed protection. This is available if you expect the amount of your pension savings to be more than £1.5 million when you come to take your benefits.It’ll allow you to keep the higher limit but will have to stop building up benefits in all registered pension schemes from 6 April 2012.

According to HMRC the application process should be available soon. If you think you’ll be affected you need to act soon.

If we can help at all please get in touch here.

Employment Law Round Up

In our day to day work we have to read a huge amount of technical information to stay up to date with the latest developments. We like to share anything that we find useful with our clients, connections and followers.

The latest bulletin that we have received is from those very nice people at the law firm Herbert Smith LLP. It’s their Round Up of Employment Law Developments for June 2011. You can click through to the bulletin here.

There is a useful slant on the Default Retirement Age and some useful catch up on the Bribery Act that’s just come into force.

It’s well worth a read as a quick catch up for issues that you may need to know about.

If you need any help after you’ve read the bulletin please contact us here.