Financial planning for the end of the tax year

The nights are finally starting to get a little lighter – maybe we can start looking forward to Spring after all. In financial services, Spring means two things; the Budget (on March 20th this year) and the end of the tax year on Friday April 5th.

The nights are finally starting to get a little lighter – maybe we can start looking forward to Spring after all. In financial services, Spring means two things; the Budget (on March 20th this year) and the end of the tax year on Friday April 5th.

This article gives some suggestions on financial planning steps to take before the end of the tax year, so that you can make the most of your tax allowances and organise your affairs as tax efficiently as possible. However, the first point to make is a practical one.

Easter is early this year, with Good Friday on March 29th and Easter Monday on April 1st. With holidays bound to impact on administration at some financial institutions, our first suggestion is that if you’re going to act before the end of the financial year, don’t leave it until the last minute. If you want to make sure your transactions are processed in time, look on the week commencing March 25th as the last practical week.

Individual Savings Accounts

The overall personal limit for an Individual Savings Account (ISA) for the current tax year is £11,280 and this will increase to £11,520 for the new tax year commencing on April 6th. It’s important to note that if you are only contributing to a cash ISA then the maximum is exactly half the overall allowance – so £5,640 and £5,760 respectively. The other key point is that if you don’t use your ISA allowances for this tax year then they are lost – they can’t be ‘carried forward’ to the next tax year.

We’d always recommend making use of your ISA allowances if you can – you pay no tax on capital gains which you make within an ISA or income you take from it. For long term investment there is a huge range of funds available within an ISA ‘wrapper’ from the very cautious to the very adventurous: as always, we’d be happy to discuss all the options with you if you’d like some advice.

Capital Gains Tax

Accountants will tell you that CGT is the ‘forgotten’ tax relief – people who religiously use their full ISA allowance completely fail to utilise their CGT allowance. For the current tax year everyone has a CGT allowance of £10,600 – meaning that capital gains made on investments such as shares are free of tax if they are within this limit. Husbands and wives can gift assets to each other without incurring a CGT charge, effectively giving a married couple a limit of £21,200. Like the ISA allowance though, the CGT allowance is an annual one, and cannot be carried forward to a subsequent tax year.

Inheritance Tax

The current individual limit for Inheritance Tax is £325,000 and this will remain the same for the tax year 2013/2014. Remember though, that you can make gifts during a tax year and these will be exempt from IHT if they fall within the Revenue limits: the limit is £3,000 per person, so £6,000 for a married couple. Although these amounts are small they can still help to reduce the value of an estate.

There are, of course, far more complex and sophisticated Inheritance Tax planning measures such as the use of trusts; if you feel that you would like specialist advice in this area then we will be happy to help.

Pensions

Why have we left pensions to (almost) the end? For a simple reason – because whilst there is enormous scope to make tax efficient investments through your pension (especially for higher-rate taxpayers) the legislation and rules are complex and it is an area where specialist financial planning advice is almost always required.

The top rate of tax is shortly being reduced from 50% to 45%, so many very high earners will be motivated to make pension contributions now, and as usual there is the chance to make use of reliefs and allowances which haven’t been used from previous tax years.

Equally, those people who are self-employed or directors of companies may need to think about making sure their pensions are as tax efficient as possible, and set up to ensure that they receive the maximum benefits from the business they are running. It all adds up to an area where specialist advice is essential and we are always ready to sit down with clients and use our expertise and experience to make sure they have exactly the right pension planning.

Hopefully that’s a useful overview of the planning steps you should take before the year end.

The key message is simple: “talk to us.” We’re never more than a phone call or an e-mail away and we’re happy to explain any of the subjects above in much greater detail.

*The Financial Services Authority does not regulate taxation advice or trusts.

New RPI and it’s impact on pension schemes

This article is only really of interest to any employers or Trustees that are involved in a final salary type pension scheme.

Those all round good people at Wragge & Co have published a short paper that outlines some of the issues that you should be considering if your Scheme provides indexation.

You can read the paper by clicking here.

As always if you need any help, or have any questions, after you have read this contact your usual 44 Financial consultant.

Steve Clark

It’s all about You!

Every now and then I come across something that strikes a chord. You know it’s that feeling that makes you stop reading a newspaper article; pause and think.

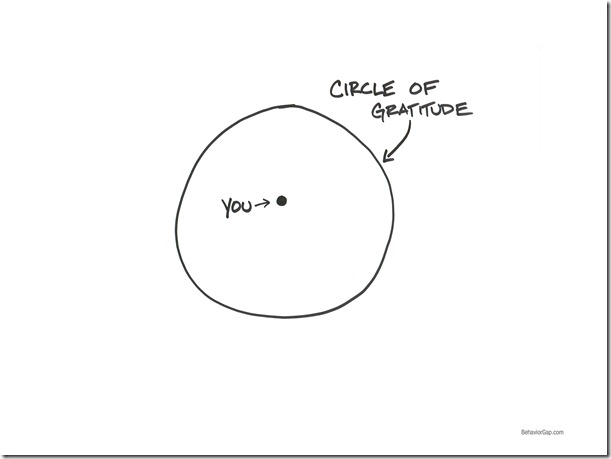

I saw this drawing by Carl Richards and just thought– that’s it. That is what 44 Financial is all about! We always keep you – our clients – at the heart of everything we do and we are always grateful that you have chosen to work with us.

Our business is built on our Win2 philosophy. Read more about Win2 by clicking here.

As 2012 begins to draw to a close I wanted to take the time to thank you all for allowing us to be your trusted adviser. We really do appreciate your continued support and, as our business continues to grow, I wanted to reassure you that you will stay at the centre of everything that we do.

Thanks again. We look forward to continuing to work with you in 2013 and beyond.

Steve Clark

If you would like to find out more about Carl Richards and his great book -the Behavior Gap: Simple Ways to Stop Doing Dumb Things with Money (yes he is American!) you can click here.

Will pension compliance cost you 10% of payroll?

Auto-enrolment could increase employers’ payroll costs by 10% according to research from Eversheds.

The legal firm surveyed 245 companies and found that more than half thought the cost of complying with the new pension rules would be as high as 10% of payroll. The biggest challenge was though to be the additional administration required.

Nearly 60% of those surveyed said they wouldn’t reduce costs by limiting future pay rises. However 16% said they would consider it.

On a positive note the 93% were confident they would be ready by their staging date.

Two of the biggest challenges were getting key messages over in simple terms and getting workers to understand the reasons behind automatic enrolment.

About a third of companies thought it likely that they’d have to communicate different messages to different categories of workers.

When asked the one thing they’d change 41% said they’d allow workers to opt-out before being enrolled. Another 20% wanted the earnings threshold to be removed from the eligibility criteria, so that employers would not have to continually monitor workers’ earnings.

Steve Clark

Supporting your employees suffering from cancer

Advising on employee benefits can be a bitter sweet experience at times. When dealing with claims you see the worse side of human frailty. However, despite this we can still make a positive difference to an employee who is ill, or their dependants if they die.

Advising on employee benefits can be a bitter sweet experience at times. When dealing with claims you see the worse side of human frailty. However, despite this we can still make a positive difference to an employee who is ill, or their dependants if they die.

One of the toughest things to deal with for an employer can be working out how best to support an employee who is affected by cancer while at the same time meeting the needs of your organisation. Macmillan Cancer Support has produced a pack of free resources especially for HR professionals, to provide you with all the information and practical advice you’ll need.

This toolkit includes expert guidance about minimising the impact of cancer on your organisation and all the individuals concerned, top tips for line managers to support their staff, and information to share with employees who’ve been diagnosed with cancer or who are caring for someone with cancer.

We strongly recommend that you have this information to hand. Visit the Macmillan website to order your free toolkit today.

Steve Clark

Photo Courtesy of Flickr: ind{yeah}