Archive for the ‘NEST’ Category

Back to School–Your Pensions Homework

It’s very difficult to keep up to speed with all of the issues that will arise on planet pensions in 2012.

To help your revision Eversheds have produced a really helpful Speedbrief that covers all of the main issues that lie ahead for us in 2012. You can click through to it here.

There’s no exam at the end of this homework. However, we hope you’ll find this summary useful.

Steve Clark

U-Turn on Planet Pensions

What a week its already been on planet pensions And it’s still only Tuesday!

Yesterday in our blog post on the new pension rules we first got some idea that the government was going to delay the introduction for some employers.  By the afternoon the Pensions Minister Steve Webb had confirmed the rumours. Smaller employers are, after all, going to be given a bit of breathing space.

By the afternoon the Pensions Minister Steve Webb had confirmed the rumours. Smaller employers are, after all, going to be given a bit of breathing space.

Now this is the same Steve Webb that told a conference almost a month ago to the day that there was no intention of postponing the introduction of the changes. It probably goes to show how little we can read into what politicians say!

So where does this leave us. It all depends on size and whether you are a small or large employer. Size is subjective and we all know that one man’s large is another woman’s small.

As it stands here is what we know from the announcement from the Department for Work & Pensions.

If you employ less than 50 employees

You’ll also get some breathing space. We know that you’ll be given until after May 2015 to comply. This is after the end of this Parliament. We’ll have to wait and see what happens at the next election. However, the government has stated that all firms will have to comply at some point.

to comply. This is after the end of this Parliament. We’ll have to wait and see what happens at the next election. However, the government has stated that all firms will have to comply at some point.

If you employ between 50 and 2,999 employees

You’ll get some breathing space. Your staging date will change but we don’t know by how much yet. The DWP will issue more guidance in January 2012.

If you employ more than 3,000 employees

You are unaffected by yesterday’s U-Turn. Your staging date is still the same. The very largest employers have to start complying from October 2012.

What does it all mean for me?

Our research indicates that the majority of companies with less than 50 employees don’t even know yet about these new pension rules.

There’s evidence that more employers in the 50 to 3,000 know about the changes but only a small proportion have started any serious planning.

Clearly, if you are one of these employers you’ll benefit from the delay. What you shouldn’t do is simply stick your head in the sand hoping the whole thing will go away. It won’t.

The delay will allow you to start looking at the cost of compliance and what impact it’ll have on your business income. You’ll also have a chance to look at what you already have in place. It’ll give you time to work out what you have to do.

All is not lost!

Don’t worry if you haven’t had a look at the new rules and how it’ll affect you.

We’re talking to a growing number of employers who are taking this opportunity to look at whether they are employing the right adviser to see them through this minefield.

If you’d like to arrange an initial meeting to find out more about our active benefits service please email us here.

Govt U-Turn on new pension rules?

There has been some murmuring recently about whether the government will change it’s mind and cut small business some slack in relation to the new pension rules coming next year.

Very recently the Pensions Minister Steve Webb rebutted this idea when he spoke in the Commons. However, on Friday an article appeared on the Daily Telegraph web site that seems to say the opposite. You can click through to the article here.

I’m not sure that this is as definitive as it sounds and we’ll probably have to wait and see if George Osborne says anything tomorrow.

It doesn’t really make sense only to exempt smaller employers as that will create a very uneven playing field if larger employers still have to comply. After all why take a job with a big employer where you have to pay 4% of your pay into a pension when you can work for a smaller employer and avoid it.

It’s all a bit of a mish-mash. Let’s hope we get some clarity soon as there are some employers who are still sticking their heads in the sand and pinning their hopes on some form of delay.

Watch this space!

Steve Clark

If FTSE 100 employers can mess up pensions this badly what hope is there for us?

My wife Sue has recently been made redundant by the drug company AstraZeneca. This morning we got a letter from AstraZeneca letting us know that they had not paid enough into Sue’s pension while she was on maternity leave. It seems they had only paid their contributions based on her reduced maternity pay rather than her full pay before her leave. All in all it seems that over 900 people like Sue were affected.

When you take into account the internal cost of reviewing the mistake and the cost of compensation I’m sure it’ll run into hundreds of thousands of pounds.

The reaso n that the AstraZeneca letter struck a chord is that I’ve spent the last couple of weeks advising employers about their duties under the new pension rules. Re-reading the detailed guidance issued by The Pensions Regulator has driven home the scale of the work that’s going to be required for employers to comply.

n that the AstraZeneca letter struck a chord is that I’ve spent the last couple of weeks advising employers about their duties under the new pension rules. Re-reading the detailed guidance issued by The Pensions Regulator has driven home the scale of the work that’s going to be required for employers to comply.

Take for example the task of identifying your workers. Not as easy as it sounds if you use self-employed contractors, agency workers or have non-executive directors, volunteers or Trustees.

Then you have to split your workforce between three categories of “jobholder” as the civil servants have called them. Then you’ve got make sure that you know when one of your jobholders moves category so you can make sure you do the right thing. I have included a graphic below from the The Pensions Regulator guidance just to give you a flavour:

It’s going to take a major change not only to HR and Payroll systems but also an Employer’s internal processes to track all these coming and goings. So, in essence, the new Rules are as much about compliance as they are the headline extra pension costs.

And that brings me nicely back to the AstraZeneca letter. Whilst it’s nice to get the compensatory payment they’ve made; it shows how badly wrong one of the top 100 quoted companies can get a simple change in process so badly wrong.

The changes required for the new pension rules dwarf the changes that AstraZeneca  should have made to their maternity policy back in 2003. For smaller employers with limited resources it’s a daunting task. A survey of HR and Finance Directors in June 2011 found that over 40% of those questioned had no idea of the deadline for complying with the new rules.

should have made to their maternity policy back in 2003. For smaller employers with limited resources it’s a daunting task. A survey of HR and Finance Directors in June 2011 found that over 40% of those questioned had no idea of the deadline for complying with the new rules.

In the words of the author of the report “It’s heading for a car crash”.

That’s why we’ve already started to plan out the compliance project with our clients. For some the start date is just over a couple of years away.

It’s not too late if you haven’t done anything yet. Click here to contact us set up a meeting as soon as possible.

Steve Clark

We’re all doomed Captain Mainwaring!

We’ve been catching up on some reading recently after all the efforts to get the web site up and running. A few weeks ago the Department for Work & Pensions issued a short overview of what employers have to do to comply with the new auto-enrolment monster that’s about to hit us all. If you want to catch up on auto-enrolment here’s a link to one of our previous blog articles on the subject.

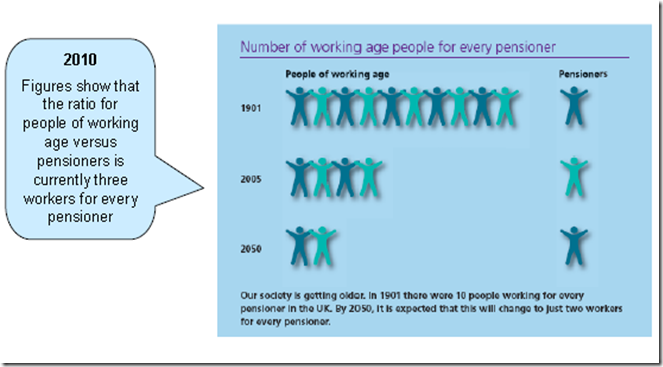

No, the thing that caught our eye in the DWP report – which you can read here – is the shaky basis upon which our state pension scheme finances are based. In the overview there’s an interesting diagram about how many workers are needed to support every pensioner that gets a state pension. We’ve included it below:

Source: DWP – Automatic Enrolment and Workplace Pension Reform – the facts. May 2011

By the looks of it by 2050 we’ll each have to adopt a pensioner and pop round every month with their pension money! Clearly, this can’t go on. That’s why successive governments have ducked the issue of state pension reform as it’s such a long term  issue. The Coalition are looking at ways of reforming the state pension by increasing the age that you can draw benefits and moving towards a flat rate £140 per week benefit. But the pay-as-you-go system that we have – where money we pay today is paid straight out in pensions – will still reach crisis point at some point in the future. Our kids and grandkids will no doubt be responsible for sorting out the mess then.

issue. The Coalition are looking at ways of reforming the state pension by increasing the age that you can draw benefits and moving towards a flat rate £140 per week benefit. But the pay-as-you-go system that we have – where money we pay today is paid straight out in pensions – will still reach crisis point at some point in the future. Our kids and grandkids will no doubt be responsible for sorting out the mess then.

Compulsion – but not as we know it

That brings us in a roundabout way to the thorny issue of savings. If we are only just going to get enough from the government to survive on the responsibility is on us all to save up now for retirement. The government thinks so too that’s why it’s making every employer in the UK automatically enrol the vast majority of their employees in a workplace pension scheme.

There are reams of research to show that most of us have been seduced by the live fast spend fast culture that the last few decades’ prosperity have  brought us. The Oddfellows issued a report last year that showed that less than one in five people had any idea what they needed to be saving up for when they stopped working. Yet there’s a feeling that when the new pension rules come in a significant number of people will opt-out. Although they won’t have to pay the contributions required they’ll also lose the employer’s contribution.

brought us. The Oddfellows issued a report last year that showed that less than one in five people had any idea what they needed to be saving up for when they stopped working. Yet there’s a feeling that when the new pension rules come in a significant number of people will opt-out. Although they won’t have to pay the contributions required they’ll also lose the employer’s contribution.

Opt-out or Opt-in?

There’s got to be an argument to say that by all means they can opt out but they still get the employer’s money. After all as a little salesman outside a carpet store in Jaisalmer said to me (on only about 100 occasions) “Something is always better than nothing”.

Our view is that eventually the ability to opt-out will disappear as so much of our future state pension planning depends on us taking responsibility for our own savings. Once it’s gone we’ll be in the situation where pension membership is compulsory – just like we were up until the 80’s when the then Conservative government abolished compulsory pension membership. Twenty odd years later and we’ve come full circle only the pension benefits on offer are a shadow of what they were in the 80’s.

A Cunning Plan?

I fear that as a nation our behaviour must change if we are to avoid living on £140 a week. I think that there is no silver bullet. Yes we need compulsory saving. If we are not going to do it ourselves we need help. But we also need to get basic financial education back into the schools. I recall the local saving bank coming into our local primary school in Dundee many years ago to collect savings. Most of the class saved something. Now you can get a credit card as soon as your 18.

Our policy to sorting out the financial health of our population has got to be more joined up and less of a knee-jerking, zig-zag of sound bite policies.

Oh, and by the way, something was indeed better than nothing. We eventually bought a wall hanging from the wee man in Jaisalmer and it still hangs in our lounge ten years later!

Steve Clark