Deadline to the Breadline?

Here’s a thought. It seems that the average person in Britain has only 19 days of savings to tide them by if the worst happens – e.g. loss of income, critic al illness or death.

al illness or death.

That’s according to the recent report from Legal & General.

There are some startling facts in there. For example the report reveals Britons typically spend more of their income on alcohol and tobacco than on protecting the income that pays for all of this with financial protection products.

And yet according to the British Gambling Prevalence Survey (BGPS) scratch cards alone were enough to tempt 24% of British adults to spend their money in this way, with 15% playing at least once a week. The “it’ll never happen to me” approach seems to be alive and well in Britain with only one in three UK adults having a life insurance policy in place.

This is disturbing when the average premium for life insurance last year, according to Legal & General, was only £189 per year. That’s around £3.50 a week.

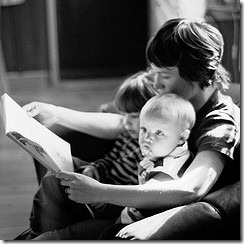

As advisers we see the aftermath of both scenarios – those that have planned ahead and those that haven’t. Two recent cases bring that into focus for me. In both cases the husband was in his 40’s and died one very suddenly and the other after a short illness.

For the couple that had planned the wife was able to repay the mortgage and had additional money for income so that the future financial security of the family to be taken care of.

For the couple who had some cover but who hadn’t updated their policies the wife didn’t have enough money to repay all the mortgage. She has had to go back to full-time working just to be able to keep the house they live in. Childcare is a major issue and they rely on a network of carers, friends and family to make it all work. There’s little excess money for when things go wrong and not a lot for luxuries like holidays, birthdays etc, When I met the wife recently she was so upset that they hadn’t reviewed their protection to make sure that they had enough.

Don’t find yourself thinking “….if only”. The 44 Financial Ltd Family Protection Review has been designed for people like you. Quite simply we’ll work with you to make sure that you and your family have money when you most need it.

To book your initial appointment click here to contact us.

Steve Clark

Credit – Photo (Flickr – swan-t)

Your 5 Minute Catch Up

Here’s a quick and easy catch up on some of the news storied we think you might want to read.

Perils of the wrong pension

Making the wrong choice with your pension can be costly. The Daily Mail told the story of a retired solicitor who was concerned about his poor state of health and wanted to secure lifetime income for his wife from his pension fund. But he bought the wrong type of annuity, one that had a guarantee period of ten years. He died only weeks after the ten year guarantee ended – and his widow was left without any income.

44 Financial offer a full retirement planning service to help make sure that you make the right choices when you are retiring.

Cap on pension charges proposed

The government has opened a consultation on an upper limit on pension charges, reports the Daily Telegraph.

Its target is older schemes, often closed to new members, that can have charges of up to 2.1% a year. Modern schemes have charges of under 1%, and the higher charges can cut pension scheme members’ retirement pots by tens of thousands of pounds.

If you have older pensions that you have not checked for some time it may be worth looking at this. Please contact 44 Financial to discuss our Pension Review & Health Check.

Fund costs are falling

Over 85% of investment funds have created new share classes with lower annual fees, according to research cited by the Daily Mail.

Previously, fund managers could pay rebates to the ‘platforms’ on which investors hold their assets out of their management fees, but new ‘clean’ share classes that pay no rebates offer investors lower charges and a better deal overall. Most platforms are in the process of switching to the new lower-cost share classes.

Charges to hit more trusts

The Chancellor’s Autumn statement is likely to include a measure that will raise charges on trusts, predicts the Daily Telegraph. At present, those seeking to avoid inheritance tax can set up a series of trusts and so long as each trust is worth less than £325,000 no tax is paid. But the legislation provides for a 6% periodic charge every ten years on larger trusts, and it is likely this tax rate will be extended to all trusts whose combined value exceeds the £325,000 threshold.

More could save from offset switch

Millions of homeowners could make useful savings by switching to an offset mortgage, says the Independent. At present only about 10% of borrowers have this type of loan, but with savings rates so low the benefit is significant. By merging your saving and mortgage accounts you avoid receiving taxable interest. Instead of earning a taxable 1% on your savings, you reduce the interest you pay on your mortgage by the amount in your savings account. With mortgage rates at 3-4% you will save far more in mortgage interest than you were earning on your savings.

Tax task forces get tough

HMRC’s tax task forces, set up to track down tax avoidance in specific sectors, are hitting their targets, reports the Daily Mail. In the first half of 2013 they collected an additional £32 million and are on target to bring in over £90 million for the full year. Restaurants, landlords and owners of second homes are among their targets.

Parents shell out more than ever

Young adults are getting an unprecedented level of financial support from their parents, reports the Daily Mail.

Over 70% of home leavers get some help, and nationally parents fork out £44 billion a year, or an average of £1,125 a year per child. But 25-29 year olds get even more, an average of £2,599 a year. The biggest items of support are property (£11 billion), cars (£4 billion) and weddings (£4 billion), but the biggest change in recent years has been the rise in the number of parents helping adult children with their living expenses – rent and bills.

Lenders target accidental landlords

Mortgage lenders are targeting ‘accidental landlords’ who they think should be paying higher interest rates, reports the Daily Telegraph.

Homeowners who have been unable to sell, have moved and rented out their homes have become landlords by accident rather than by choice. They should have informed their lenders and converted from residential to buy-to-let mortgages, but hundreds of thousands have not done so. Often the lender’s buy-to-let interest rate will be as much as 2% above the residential rate.

Mortgage brokers say people whose properties are worth more than their loans can usually re-mortgage to a more favourable rate if their own lender’s but-to-let rate is high, but that those in negative equity are trapped and have to accept their existing lender’s terms.

Don’t you just love it when……….

Someone does something that saves you a tremendous amount of time.

Well this month’s “Don’t you just love it….” award goes to those legal bods over at DLA Piper for their latest edition of Pensions News.

It’s got all the latest stuff on Auto-Enrolment, The Pensions Regulator, Pension Protection Fund, changes in legislation and so much more. And yet you can have all access to this in the time that you take to drink a nice cup of Nambarrie tea – Northern Ireland’s finest.

If all this suspense is too much click this link to get your pensions fix – courtesy of DLA Piper.

Steve Clark

Power struggle

In an ageing society, more people need others to take decisions on their behalf.

But the law is quite strict on this. So if you need to take decisions on behalf of a relative you need a Lasting Power of Attorney.

The Financial Times’ guide recently published said that while you can just appoint one or more relatives (two is better than one in case the individual isn’t available when urgently needed), many people also appoint a solicitor as one of their attorneys.

Registering an LPA takes about 4 weeks.

Although not a nice thing to think about getting the right LPA in place can make life much easier for your loved ones if you are unable to make your own decisions in the future.

We work with a number of specialist legal firms who would be happy to chat through the options for you. Give us a call on 0116 380 0133 if you’d like us to introduce you to someone who understands the problem and can help.

Steve Clark